Coway operates a company-wide risk-management system by dividing risks that may arise from business activities into financial risks and non-financial risks; and manages and supervises them through the Committees under the BOD and the business Divisions according to the type and importance of risks.

Financial risks related to markets, credit, liquidity, etc. are handled by Finance Department, while non-financial risks, such as regulations, policies, quality, labor, human rights, safety and the environment, are handled by the ESG Committee.

The financial and non-financial risk-management organizations operate risk-monitoring systems that periodically identify and inspect risks, and analyze the impact of each risk factor.

Key issues derived through such monitoring are reported to the BOD, and follow-up actions are implemented by a company-wide response system, taking into account the potential impact and urgency of the risk.

Risk-Management Reporting Structure

Management of Financial Risk

Financial risk management focuses on the unpredictability of financial markets, identifies, evaluates, and avoids financial risks, and eliminates factors that have a potentially adverse impact on financial performance.

The major financial risks managed by the company are divided into market risk, credit risk, liquidity risk and capital risk, respectively.

Market Risk

Market risk (interest rate risk, foreign exchange risk and other price risks) is the risk by which the fair value of a financial instrument for future cash flow will fluctuate due to changes in market prices.

The management pays attention to changes in financial indicators, such as exchange rates and interest rates; periodically reviews interest rate trends to monitor risks that may have a negative impact on the company's value; and prepares follow-up arrangements to ensure an appropriate balance between fixed-rate and floating-rate borrowings.

Additionally, the company regularly evaluates, manages, and reports risks related to exchange rate fluctuations.

| Increase/decrease of foreign currency exchange rate |

When increased by 5% |

When decreased by 5% |

| Increase of EBIT |

Increase by KRW 6,134 million |

Decrease by KRW 6,134 million |

Credit Risk

Credit risk is managed at the consolidated company level.

Credit risk arises not only from customers, including account receivables held and confirmed contracts, but also from cash, cash equivalents, financial derivatives, and deposits at banks and financial institutions.

Coway deals only with banks and financial institutions that have obtained a credit rating of at least “A” from an independent credit-rating agency, and in the case of clients without an independent credit rating, the company evaluates the credit of customers by considering other factors, such as the customer's financial status and past experience, to determine the risk limit.

Liquidity Risk

Coway manages the credit-tightening risk due to changes in the financial market in advance and analyzes the impact on financing to establish a preemptive response system.

In particular, Coway constantly monitors liquidity outlook to ensure that the unused borrowings are kept at an appropriate level, and ensure that the demand for operating cash is satisfied, so that the company will not violate borrowing limits or agreements.

When forecasting liquidity, Coway refers to legal or regulatory requirements related to, for example, the consolidated company's financing plan, compliance with agreements, internal target financial ratios, and currency restrictions.

Capital Risk

Coway maintains an optimal capital structure to continuously provide profits to shareholders and stakeholders and reduce capital costs.

Like other companies in the industry, the consolidated company manages its capital based on its capital financing ratio.

Management of Non-financial Risks

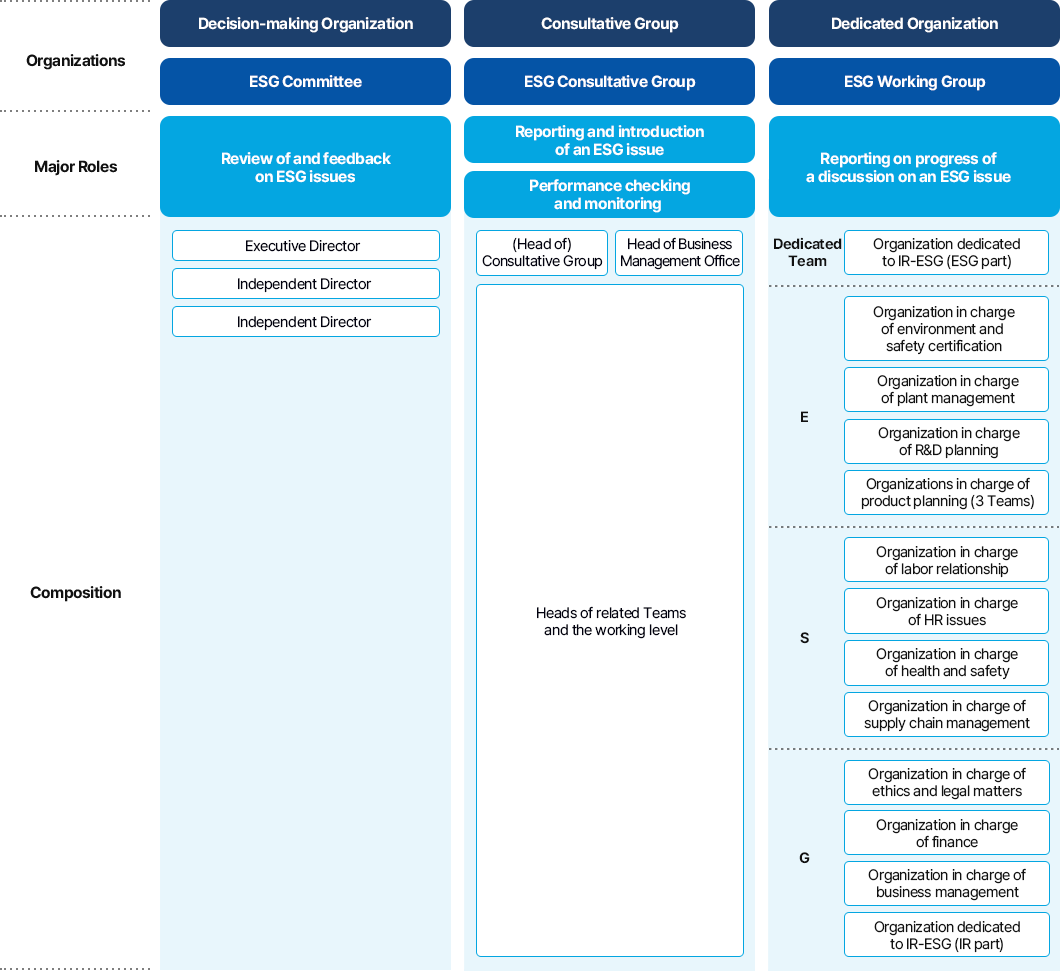

Coway established the ESG Committee under the BOD to strengthen management and supervision of ESG risks, such as ethics, environment, labor, human rights, and supply chains.

Also, Coway established the ESG Council (which holds meetings quarterly) and a working group (which holds meetings as necessary) under the ESG Committee, which will monitor non-financial risks in different areas and report major risks to the ESG Committee regularly (half-yearly).

ESG Committee Meeting Record

| Category |

Date |

Major agendas |

Reporting characteristics |

| 1st meeting |

May 2023 |

Report on the results of the previous year’s ESG evaluation grade

Interim report on strategic ESG tasks for 2023

Report on results of materiality assessment for the 2023 Sustainability Report

|

Report

Report

Report

|

| 2nd meeting |

December 2023 |

Decision on Coway’s internal carbon-price standards

Decision on renewable-energy credit (“REC”) handling method

Report on strategic ESG task plan for 2024

|

Approval

Approval

Report

|

ESG Council Meetings

| Category |

Date |

Major agendas |

| 1st meeting |

May 2023 |

Establishment of ESG strategies and goals

Establishment of diversity and inclusion policies

Expansion of ESG evaluation of the supply chain

|

| 2nd meeting |

July 2023 |

Review of the 2023 sustainability report by the working group

Progress of ESG technology tasks carried out by Environmental Technology Institute

Status of and plans for response to conflict minerals

|

| 3rd meeting |

September 2023 |

Plan for advancement of Task Force on Climate-related Financial Disclosure (“TCFD”) disclosure

Human Rights Impact Assessment Plan (Draft)

|

| 4th meeting |

December 2023 |

Result of establishing the Scope-3 management system

Biodiversity activity strategy (draft)

Improvement-task implementation for 2024

|