Overview of Climate Scenario Analysis

Coway conducted a climate-scenario analysis to establish internal strategies and make decisions to respond to climate change. In the analysis, internal key data were reflected in scenarios presented by international consultative bodies such as NGFS and IPCC SSP (SSP1-2.6, SSP5-8.5) to identify physical risks and transition (implementation) risks due to climate change. Physical risks are based on climate scenarios from the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report, reflecting low-emission scenarios (*SPP1-2. 6) and high-emission scenarios (*SSP5-8. 5) in the short, medium, and long term.

* SSP (Shared Socioeconomic Pathway): A scenario that applies radiant energy changes to the Earth as of 2100 and changes in future socioeconomic systems such as population, economy, and energy use.

Transition risk is based on the Network for Greening the Financial System's (NGFS) *GCAM (Global Change Analysis Model) 6.0 model, reflecting low-emission scenarios (Net-zero 2050) and high-emission scenarios ― Nationally Determined Contributions (NDCs, from 2023 to 2050.

* GCAM 6.0: NGFS's Integrated Climate and Economic Assessment Model provide integrated information on consumer goods demand and supply, population changes, and price changes for 32 regions under climate-change scenarios.

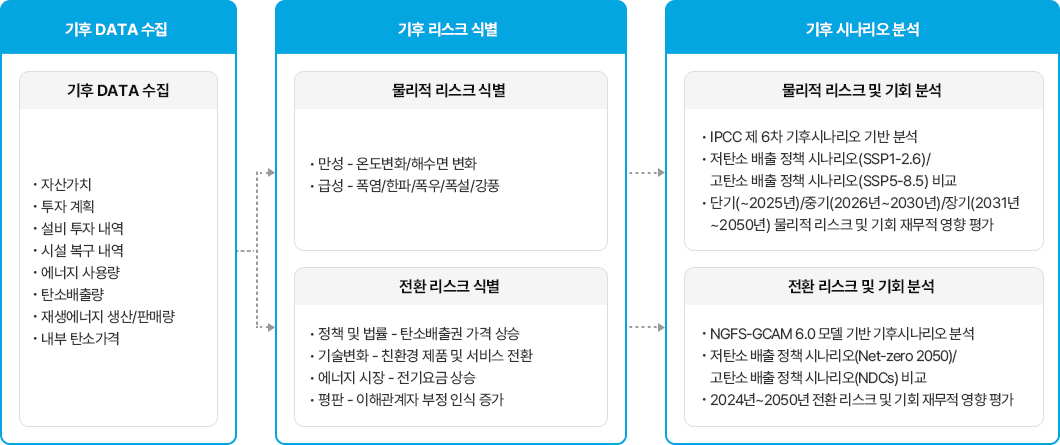

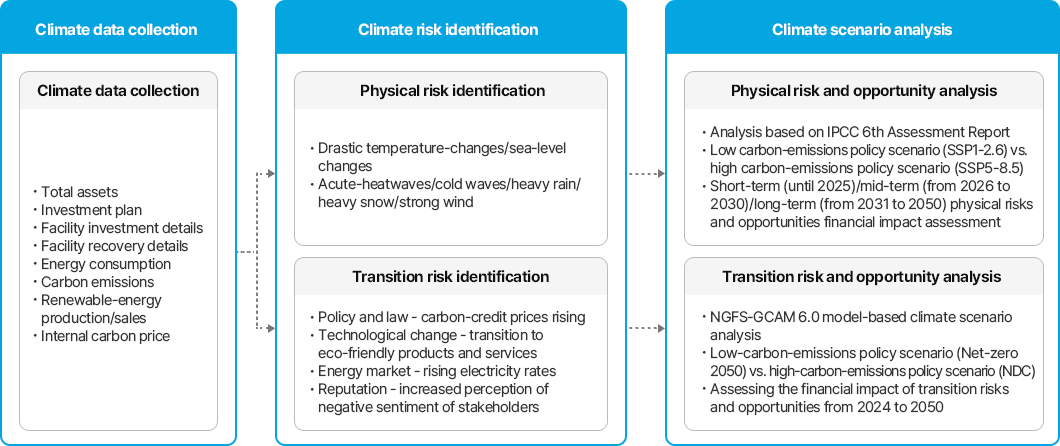

Climate-Scenario Analysis Process

Identification of Climate Risk

To analyze the impact (risk) of climate-change on the company, Coway collected past asset-information (investment and maintenance costs) and environmental information (carbon emissions/energy consumption), and identified various issues in advance through interviews with relevant departments. We used it to conduct predictive analytics on a short- medium- and long-term basis. Among physical risks, ‘acute risks’ refers to impacts from sudden weather events, while ‘chronic risks’ refers to gradual changes in the environment due to climate change. And ‘transition (implementation) risks’ refers to risks resulting from changes in policy and the social environment. The analysis identified the main risks as 'heatwaves,' 'heavy rain/snow,' 'temperature changes,' 'policy and legislation,' and 'energy markets,' with each of the five factors expected to have a progressively increasing impact through 2050. Moreover, technological changes do not have a direct impact, but there is a possibility, which, in turn, requires a response strategy.

Based on the climate-change risk analysis, Coway will strive to effectively reduce the impacts (risks) of climate change in the future and develop the company's own capability to adapt to climate change

Climate Change Risk Impact Assessment

| Risks |

Category |

Description |

Impact |

| Years |

Short-term

(until 2025) |

Mid-term

(from 2026 to 2030) |

Long-term

(from 2031 to 2050) |

| Physical risks |

Acute |

Heatwave |

Facility investment costs due to heatwaves |

|

|

|

| Cold waves |

Cost of increased facility investment and energy consumption due to cold waves |

|

|

|

| Heavy rain/snowfall |

Costs to repair damage caused by heavy rain/snowfall |

|

|

|

| Gale |

Costs to repair damage caused by high winds |

|

|

|

| Chronic |

Temperature change |

Cost of increased facility investment and energy consumption due to prolonged exposure to high temperatures |

|

|

|

| Sea-level changes |

Flood damage costs due to rising sea levels |

|

|

|

| Transition risk |

Policy and Law |

Cost of rising prices due to carbon-credit policies |

|

|

|

| Technological changes |

Costs of providing eco-friendly products and services |

|

|

|

| Energy market |

Cost due to rising energy costs |

|

|

|

| Reputation |

Decrease in sales and investment due to poor customer reputation |

|

|

|

Climate scenario analysis and financial impact assessment

The scenarios presented in this Report had been prepared based on various assumptions and forecasts, and the actual outcomes may differ from those suggested by the scenarios. Coway will refer to the scenarios when establishing plans and strategies related to ESG and continuously advancing the scenarios.

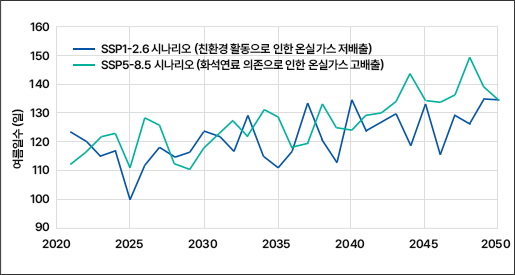

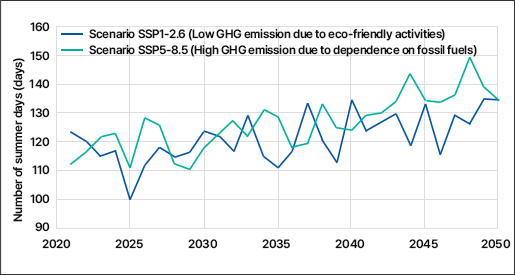

Physical Risk 1: Temperature Changes and Heat Waves

*Change in number of summer days according to IPCC climate scenario

The number of summer days for the heatwave/temperature change physical risk analysis shows an irregular increasing trend until 2050 for both IPCC SSP low-emission (SSP1-2.6) and high-emission (SSP5-8.5) scenarios. This means that as the average global temperature rises, the number of *summer days increases, and so does the electricity consumption for cooling.

* Number of summer days: The first to last day in which the average daily temperature rises and remains above 20℃.

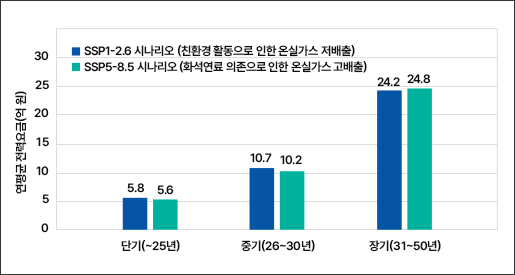

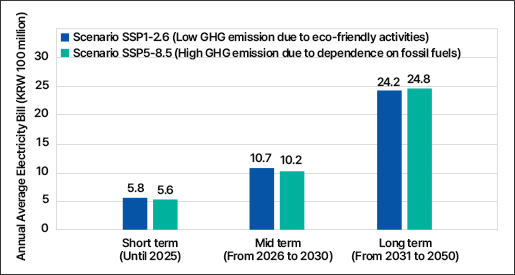

Financial impact of increased power consumption due to temperature changes

To analyze the financial impact of climate change, we have analyzed the scenarios referring to the IPCC climate scenario, the past revenue growth rate of the company and the subsequent use of electricity.

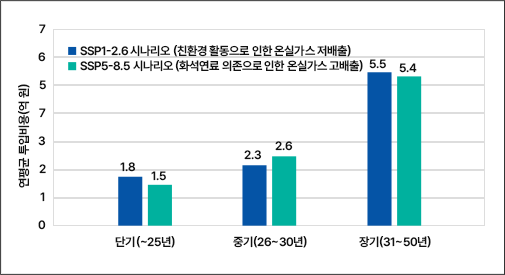

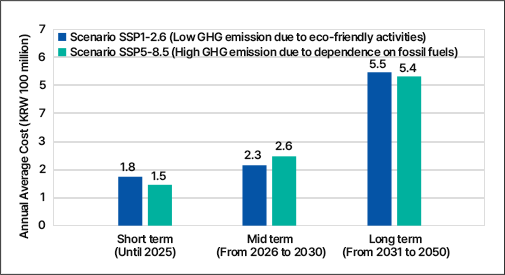

When assumed that the increase of number of summer days as suggested by the climate scenario, increase of production caused by the growth of company, subsequent growth of use of electricity and increase of price of electricity, the financial impact is expected to increase at the annual average of KRW 2.42 billion (Scenario SSP1-2.6) to KRW 2.48 billion (Scenario SSP5-8.5), from a long-term perspective (2031 to 2050).

Physical Risk 2: Heavy rain

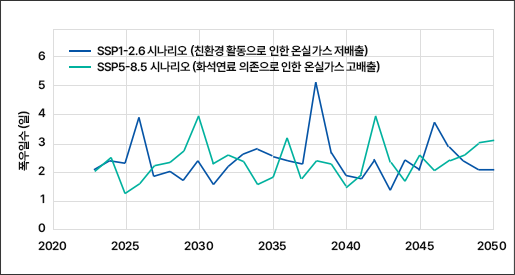

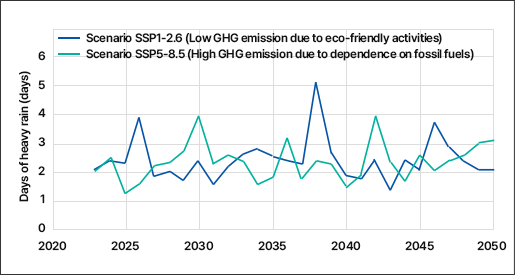

*Changes in the number of days of heavy rain according to the IPCC climate scenario

The number of heavy precipitation days for the heavy precipitation physical risk analysis shows no increasing trend for both IPCC SSP low-emission (SSP1-2.6) and high-emission (SSP5-8.5) scenarios.

* Heavy precipitation days: more than 30 mm per hour, more than 80 mm per day or daily precipitation is 10% of the annual precipitation.

Financial impact of recovery costs due to heavy precipitation

To analyze the financial impact of heavy precipitation, Coway identified the past cost of restoring its facilities and increase and/or decrease of asse value.

According to the climate scenario, the frequency of heavy precipitation is expected to remain steady until 2050. However, the continued increase of the company’s asset value may increase the financial burden when damage occurs due to heavy precipitation. Accordingly, the company is making efforts to minimize the risk and prevent damages by heavy precipitation, such as flooding, electricity outage or loss of properties, by strengthening its prior inspection of its business sites.

Transition Risk 1: Policy and Law

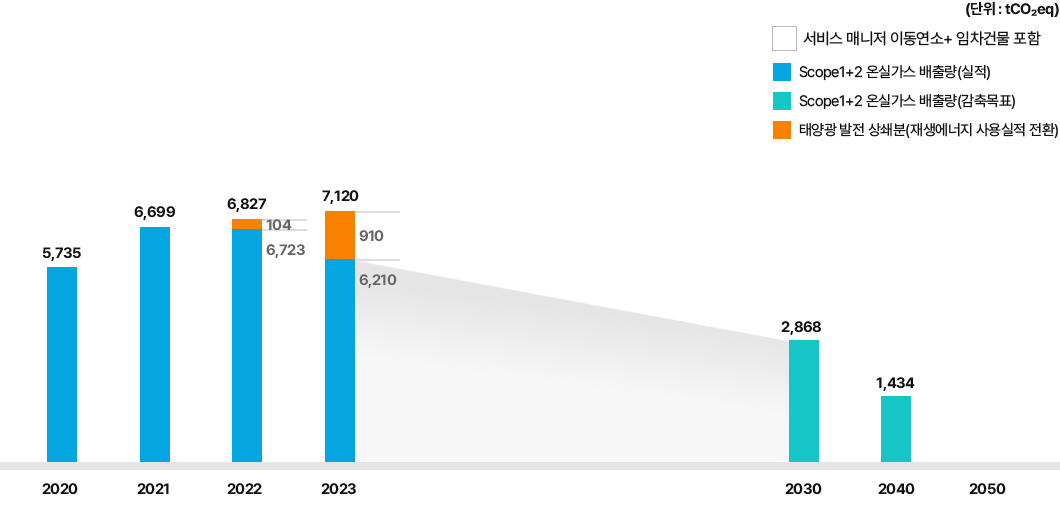

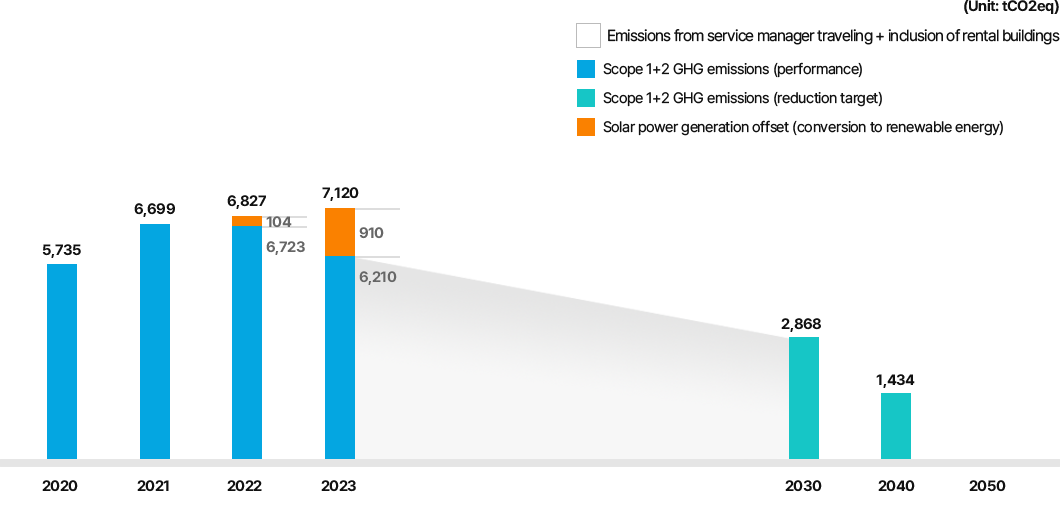

Carbon emissions according to net-zero scenario

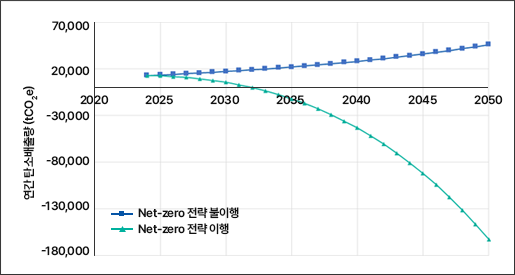

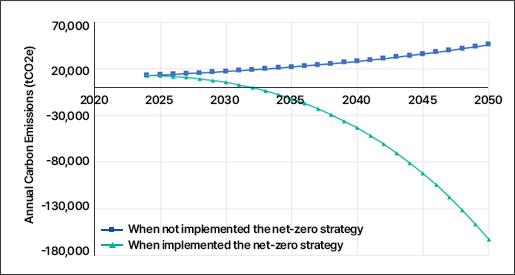

Coway expects its carbon emissions to increase until 2050, if the net-zero strategy is not implemented. By year, it is expected that approximately 18,118tCO₂e will be emitted in 2030 and approximately 48,000tCO₂e in 2050. However, assuming that the company annually invests in the photovoltaic power generation facility until 2050, it is expected to achieve net-zero ahead of the schedule, by 2033. The photovoltaic power generation facility construction plan is included in Coway’s GHG emission reduction strategy, for which some conditions, such as financial resources, land, permit, etc., must be met. Coway will make efforts to achieve net-zero by 2050 referring to the applicable scenario.

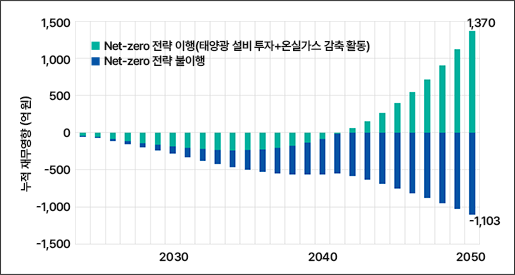

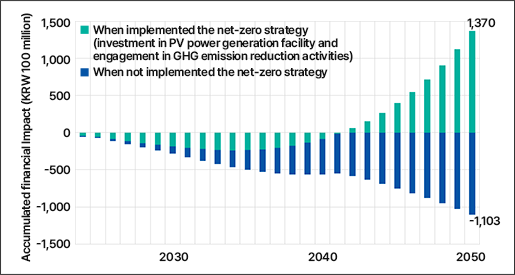

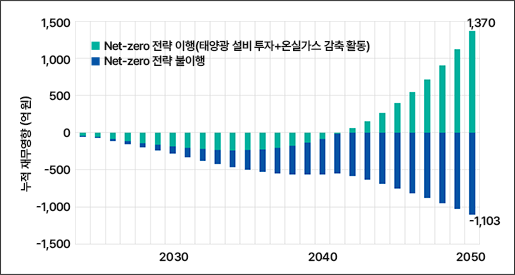

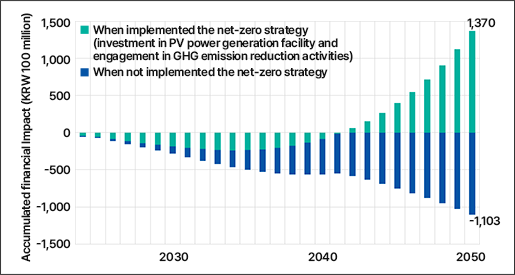

Financial impact according to net-zero scenario

The financial impact was analyzed based on the net-zero scenario in the left. Provided that the net-zero strategy is not implemented, Coway expects that the accumulated financial impact of GHG emission will reach KRW 110.3 billion by 2050 (when translated Coway’s GHG emission scenario into a monetary value considering the price of carbon emission). Meanwhile, provided that the net-zero strategy is implemented as prescribed by the net-zero scenario, an accumulated profit of KRW 137.0 billion by 2050 is expected. The net-zero scenario assumes that the company builds 27 PV power generation plants of annual capacity of 1,000kW from 2024 to 2050. Accordingly, there may be financial burden in the earlier period of the strategy because of investment in the power plant, but Coway is expected to reach the break-even point by trading the carbon emission right as time passes and result in the profit of KRW 137.0 in 2050. Thus, it is expected that approximately KRW 247.3 billion benefit to Coway when included the cost that would arise when not implemented the net-zero strategy.

Transition Risk 2: Market Change

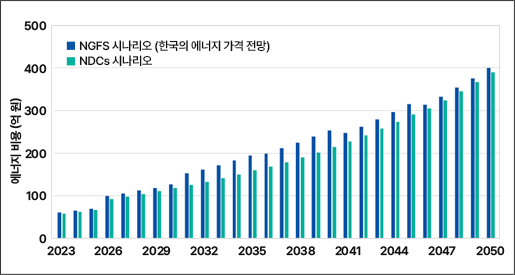

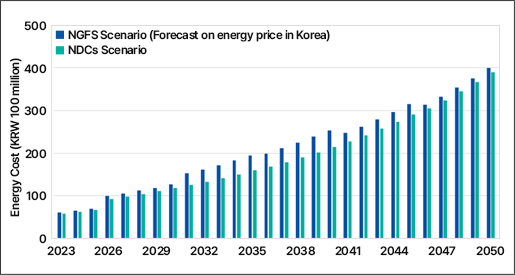

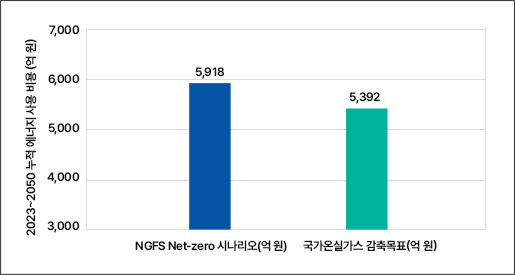

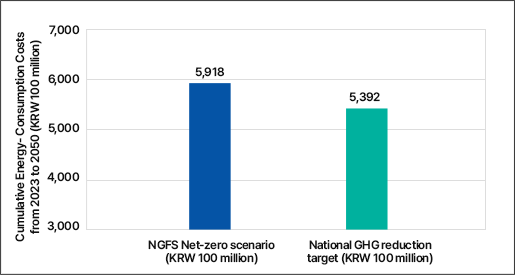

NGFS scenario-based energy-cost estimation

Both *NGFS Korean energy price scenario and *NDCs scenario used to estimate the cost of energy anticipates that the cost of energy will rise until 2050. When the two scenarios estimated the cost of energy, they applied the future energy use of Coway, and the estimation calculated thereby was approximately KRW 40.0 billion in 2050.

* NGFS: Network for Greening the Financial System

* NDCs: National greenhouse gas reduction targets set by participating countries according to the Paris Agreement on climate change

NGFS scenario-based financial-impact estimation

When totaled the cost of energy from 2023 to 2050 based on the estimated price of energy, the costs of energy based on NGFS scenario and NDCs scenario were KRW 591.8 billion and 539.2 billion, respectively. Coway will seek ways to use energy more efficiently and strengthen the RE100 strategy (under which the source of electricity required by the business sites will be converted to renewable energy sources) to alleviate the energy cost risk that the corporate community will experience in the future. By doing so, Coway will strive to reduce the financial risk arising from use of energy.